Leveraged Recapitalization

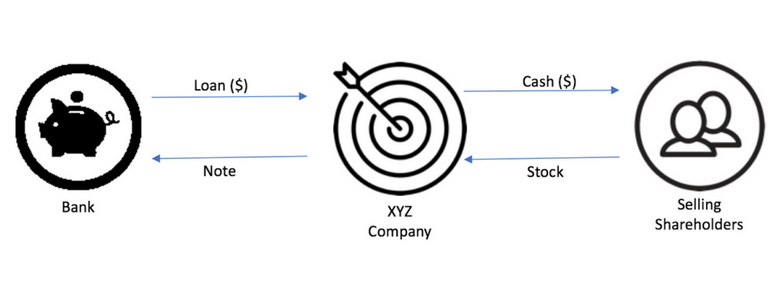

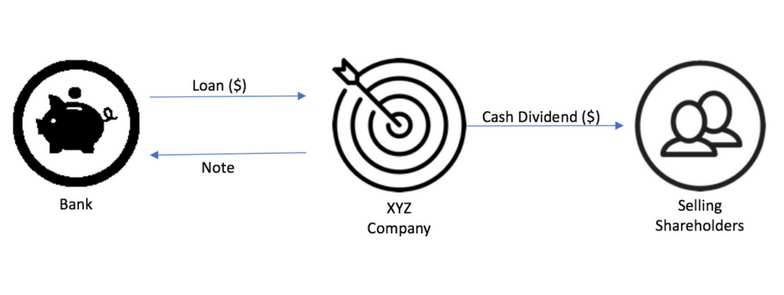

A leveraged capitalization is a means of achieving share holder liquidity whereby the company borrows money to repurchase shareholder stock or to pay a significant cash dividend to shareholders.

- Purchase of Stock

- Cash Dividend

VALUATION ISSUES

Since there are typically no third-party buyers in a leveraged recapitalization, a more relevant issue than valuation is the borrowing capacity of your company – the ability to repay debt. Furthermore, if the recapitalization involves an exchange of existing securities for new securities, the design and parameters of the new securities must be established.

POST TRANSACTION FINANCIAL RISK

Post-transaction financial risk depends not only on the absolute amount of debt incurred, but also on the repayment terms and conditions associated with the debt. A flexible financing structure that allows for the future needs of the company can reduce risk. This is typically accomplished by including subordinated debt in the capital structure since subordinated debt usually allows for longer-term amortization.Since lenders are concerned with the ongoing stability of the company’s operations in order to ensure debt repayment, management typically remains intact after the transaction.

POST TRANSACTION MANAGEMENT INVOLVEMENT

Since lenders are concerned with the ongoing stability of the company’s operations in order to ensure debt repayment, management typically remains intact after the transaction.

OTHER CONSIDERATIONS

Leveraged recapitalizations are effectively limited to 80 percent to 90 percent of company value due to the debt incurred. This type of transaction can allow for management equity participation since the increase in debt reduces the value of equity in the company. Accordingly, key management personnel may be allowed to purchase equity at this reduced value and, as debt is repaid, participate in future equity appreciation. Existing shareholders will participate in future equity appreciation as well.

FINANCIAL DISCLOSURE

Disclosure of sensitive information is typically limited to your investment banker and specified capital sources.

TAX CONSIDERATIONS OF SELLING SHAREHOLDERS

The tax ramifications of a leveraged recapitalization can be more complex than those of the other alternatives presented. Accordingly, with a leveraged recapitalization, as with the other alternatives, we suggest you consult a competent tax professional in your decision making process. Notwithstanding, we offer the following tax overview of a leveraged recapitalization under the assumption that you are the sole shareholder of your company, which is not an “S” corporation.

Whether the leveraged recapitalization is structured as a purchase of stock or a cash dividend, the tax ramifications are the same. There are three elements to these tax ramifications:

- If your company has accumulated earning and profits (similar to retained earnings), the distribution is considered a dividend, taxed at ordinary personal income tax rates, to the extent of accumulated earnings and profits.

- The part of the distribution in excess of earnings and profits is considered a return of capital and is not taxed to the extent of the tax basis in the underlying stock.

- The part of the distribution in excess of both earnings and profits and the tax basis in the underlying stock is taxed at ordinary personal or capital gains income tax rates which, at present, are the same.

Repurchase Shareholder Stock (top image); Pay a Significant Cash Dividend to Shareholder (bottom image)