Managment Leveraged Buyouts

VALUATION ISSUES

A management leveraged buyout transaction is typically accomplished at a control level of value. In a public company transaction, it is important that the transaction be fair, from a financial perspective, to selling shareholders, which will be determined by an investment banker. Furthermore, the cash flow generating capabilities of the company must be analyzed to determine the debt capacity and capital structure of the transaction.

POST TRANSACTION FINANCIAL RISK

POST TRANSACTION MANAGEMENT INVOLVEMENT

By definition, certain levels of management remain. Selling shareholders who are also managers may or may not be involved with the company after the transaction.

OTHER CONSIDERATIONS

Management leveraged buyouts may require significant cash equity from the management buyout group, which may not be readily available. Often times, a leverages buyout sponsor, such as Fenner & Beane, LP. may structure the transaction and provide the required cash equity for a controlling interest in the company. In this event, the post-transaction management structure of the company should be fully addressed.

FINANCIAL DISCLOSURE

Disclosure of sensitive information is typically limited to your investment banker, specified capital sources and appropriate company management personnel.

TAX CONSIDERATIONS OF SELLING SHAREHOLDERS

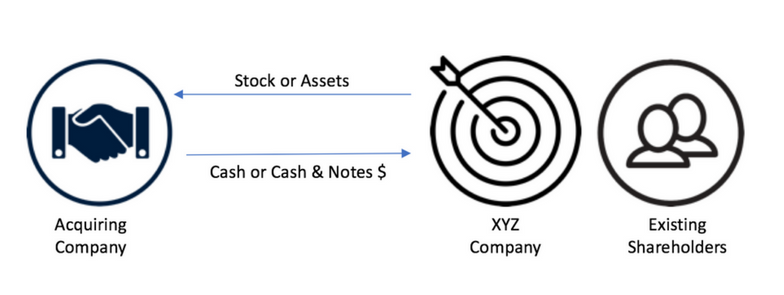

When you sell your company, you can sell either the stock of the assets of the company. The decision can be a complex one involving tax and liability issues. In a stock sale, you will be taxed on the sales price less the basis in the stock sold at ordinary personal or capital gains income tax rates which, at present, are the same. In a sale of assets, your company will be taxed on the sales price less the adjusted tax basis of the assets sold.

If your company transfers the proceeds from the asset sale to you by way of a dividend, you are taxed at ordinary income tax rates. If your company transfers the proceeds from the asset sale to you by way of a liquidation, you are taxed on the difference between the liquidations proceeds and the tax basis in your stock at ordinary personal or capital gains income tax rates. This double taxation in a sale of assets may be avoided if your company is an “S” corporation. Furthermore, receiving sale proceeds over time under an installment sale could defer your tax liability.