ESOP Leveraged Buyout

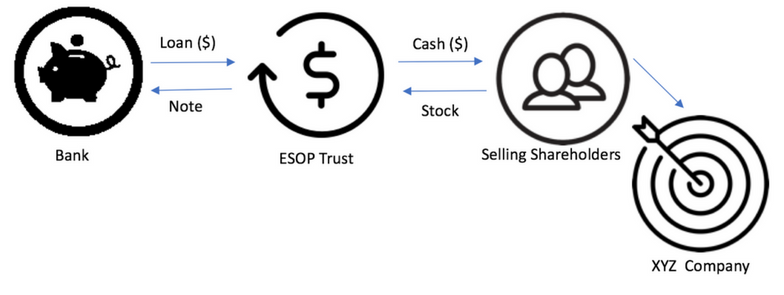

A management leveraged buyout transaction is typically accomplished at a control level of value. In a public company transaction, it is important that the transaction be fair, from a financial perspective, to selling shareholders, which will be determined by an investment banker. Furthermore, the cash flow generating capabilities of the company must be analyzed to determine the debt capacity and capital structure of the transaction.

VALUATION ISSUES

The appropriate level of value for a leveraged ESOP transaction will depend upon the amount of stock being sold to the ESOP. If more that 50 percent of the company’s stock is sold to the ESOP, a controlling interest level of value is appropriate. Alternatively, if less than 50 percent of the company’s stock is sold to the ESOP, a marketable minority interest level of value will be used. Furthermore, the cash flow generating capabilities of the company must be analyzed to determine the debt capacity and capital structure of the transaction. It is especially important in an ESOP leveraged buyout to assure that the employees are not paying greater than fair market value for the company’s stock since the transaction may be subject to U.S. Department of Labor scrutiny.

POST TRANSACTION FINANCIAL RISK

FINANCIAL DISCLOSURE

Disclosure of sensitive information is typically limited to your investment banker, specified capital sources, the ESOP trustee and, to some extent, company employees.

TAX CONSIDERATIONS OF SELLING SHAREHOLDERS

The Internal Revenue Code allows indefinite tax deferral on certain sales to ESOP’s so long as the ESOP ends up with 30 percent or more of the company’s equity after the transaction and the sale proceeds are reinvested by you in qualified securities.

POST TRANSACTION MANAGEMENT INVOLVEMENT

Lenders may require certain key managers, even if they are selling shareholders, to remain for a specified period of time in order to ensure stability of operations for debt repayment.

OTHER CONSIDERATIONS

Aside from tax considerations, there are several other benefits to ESOP leveraged buyouts. Typically, the financing can be arranged at reduced borrowing rates and principal amortization on ESOP debt can be made on a pretax basis. Dividends paid on ESOP securities can be tax deductible and used for ESOP debt repayment as well. It is not uncommon for employee morale and productivity to increase since substantially all employees participate in post-transaction equity appreciation. The ESOP may even be an acceptable and less expensive substitute for existing employee benefit programs. Another significant benefit is that an ESOP creates a market for future stock sales and puts stock in the hands of long-term investors.

Other ESOP attributes must also be considered. For example, an ESOP administrative committee must be established to monitor employee interests. This ESOP committee must be chosen carefully since it may have a considerable impact on the voting of ESOP shares. It is possible that transaction scrutiny may come from the U.S. Department of Labor or the IRS. As a final note, a very important ESOP requirement allows departed employees to “put” their shares back to the company, thereby creating a repurchase liability which must be calculated.