Initial Public Offerings & Reverse Mergers with Existing Public Company

VALUATION ISSUES

Since no one purchaser is likely to acquire a controlling interest in your company, a marketable minority interest valuation is appropriate.

POST TRANSACTION FINANCIAL RISK

FINANCIAL DISCLOSURE

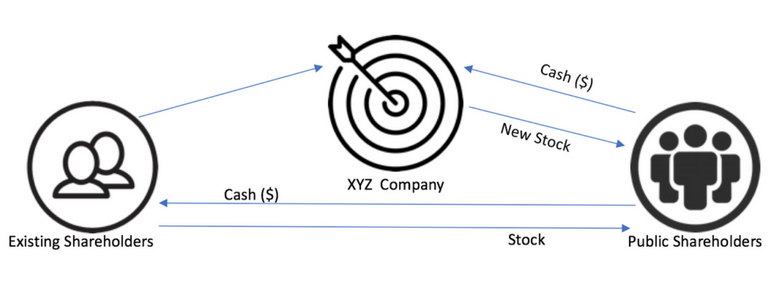

An initial public offering (IPO) as does a Secondary offering, requires pre-offering and ongoing complete disclosure to the SEC and to the public.

TAX CONSIDERATIONS OF SELLING SHAREHOLDERS

If existing shareholders sell stock, taxes are paid on the sales proceeds less the tax basis in the stock sold at ordinary personal or capital gains income tax rates which, at present, are the same.

POST TRANSACTION MANAGEMENT INVOLVEMENT

Management typically remains intact.

OTHER CONSIDERATIONS

A number of issues must be considered prior to an initial or secondary public offering. Timing is important in that the current public marketplace appetite for IPOs in general and for companies in your specific industry must be evaluated. Furthermore, SEC Rule 144 restricts the public sale of certain restricted shares which may be owned by a controlling shareholder or certain insiders or which may have been acquired in a private placement. In addition to the ongoing time commitment for financial reporting and shareholder relations, management assumes a fiduciary responsibility to the company’s shareholders and may even develop a short-term earnings orientation. An initial public offering can satisfy a company’s capital and liquidity needs in one transaction while establishing an avenue for future liquidity and financing