Sale of a Company

VALUATION ISSUES

Valuation issues unique to a sale of your company can impact the price paid to you. An appropriate controlling interest value per share must be determined, assuming a sale in excess of 50 percent of your company. Furthermore, a strategic buyer that can achieve synergies with your company may pay more than a financial buyer purchasing solely for investment purposes.

POST TRANSACTION FINANCIAL RISK

If you assist in financing the acquisition of your company by way of an earn out, management contract, or debt or equity security, your risk depends on post-transaction financial leverage, company management and the type of debt or equity security you take back. For example, a more senior security may be less risky but it will also provide a lower rate of return either through lower interest payments or dividends and/or lower equity appreciation potential.

POST TRANSACTION MANAGEMENT INVOLVEMENT

Your involvement in the management of your company after a sale will depend on whether or not there are earn outs or management contracts for your services. Such earn outs and management contracts are negotiated as part of the purchase price and typically cover a period of one to five years. A financial buyer is more likely than a strategic buyer to require your expertise after the sale.

OTHER CONSIDERATIONS

Selling your company allows you total discretion regarding who the buyer will be. It can be an effective means of gaining shareholder liquidity without burdening your company with significant debt. Furthermore, it can be an effective means of strategically divesting your company of specific divisions.

FINANCIAL DISCLOSURE

You control the release of sensitive information on your company by pre-screening prospective buyers, all of which should be bound by a confidentiality agreement.

TAX CONSIDERATIONS OF SELLING SHAREHOLDERS

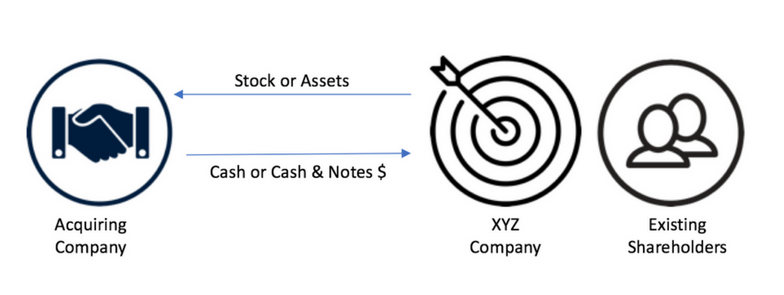

When you sell your company, you can sell either the stock or the assets of the company. The decision can be a complex one involving tax and liability issues. In a stock sale, you will be taxed on the sales price less the basis in the stock sold at ordinary personal or capital gains income tax rates that, at present, are the same. In a sale of assets, your company will be taxed on the sales price less the adjusted tax basis of the assets sold. If your company transfers the proceeds from the asset sale to you by way of a dividend, you are taxed at ordinary personal income tax rates. If your company transfers the proceeds from the asset sale to you by way of liquidation, you are taxed on the difference between the liquidation proceeds and the tax basis in your stock at ordinary personal or capital gains income tax rates. This double taxation may be avoided if your company is an “S” corporation. Furthermore, receiving sale proceeds over time under an installment sale could defer your tax liability.